Remembering charitable causes you care about through a gift to a fund at Community Foundation Tampa Bay in your will or living trust is a wonderful way for you to make a lasting gift. Large or small, your gift will make an important contribution to the long-term strength and ability of those causes to carry on with their activities.

But what if you don't have a will or living trust? You are not alone. Most Americans don’t have a will.

Without a will, the laws of your state will decide how your estate is divided. Typically, the probate court will divide your estate among your closest surviving family members according to a formula, and none of your estate can go to charity. If you wish to have a say in how your estate is distributed, you must have a will or living trust. We encourage you to work with an experienced attorney to create a will or living trust that accomplishes your goals for your estate.

Ways You Can Define a Charitable Gift in Your Estate Plan

There are several ways that you can define the amount of your charitable gift to a fund at Community Foundation Tampa Bay. They are:

- A gift of a particular amount of money. For example, you give $25,000.

- A gift of a specific item or items. For example, you give 1,000 shares of ABC Corporation.

- A gift that will be made only if one or more conditions are met. For example, you give $25,000 provided the nonprofit your fund supports still offers a particular program or service and your spouse does not survive you.

- A gift that will be made from the remainder of your estate once all other bequests, debts, and taxes have been paid. For example, you give 25% of the remainder of your estate. Often called a "residuary bequest," this approach assures that your family will be taken care of before your estate makes a bequest to us.

Ways to Specify How We May Use Your Will or Trust Gift

You have several options for telling Community Foundation Tampa Bay how we may use the gift in your will or trust once we receive it. They are:

- An Unrestricted Gift: This is a gift to our Community Impact Fund or our operating fund. This can be the most useful kind of gift because it allows us to put your gift to the best possible use in support of nonprofits whose work are changing lives and making a difference in our community.

- A Restricted Gift: This is a gift to create or add to a fund that supports designated areas of charitable interest such as education or the environment or directs support to specific nonprofits you name. It is best for you to consult with us before placing restrictions in your will or trust gift provision to be sure we can carry out your wishes.

- An Endowed Gift: This is a gift to an existing endowment fund or to create an endowment fund. We distribute the earnings from endowment funds in accordance with our endowment spending policy. This approach assures that your gift will continue to benefit the charitable causes you want to support long after you're gone. An endowed gift in your will or trust can be restricted or unrestricted.

- An Honorary Gift: This is a gift made in honor of someone else. Any form of gift in your will or trust can also be an honorary gift. We would be pleased to recognize the people you wish to honor with your gift.

Make Sure We Can Carry Out Your Wishes

It is very important that the gift in your will or trust be accurately and clearly described in your estate plan so that we can carry out your wishes as you intended. We are pleased to consult with you and your attorney regarding the terms of the gift in your will or trust to make sure that we will be able to carry out your intentions. In order to avoid any possible question that the gift in your will or trust is to our organization, be sure to include our full legal name, our federal tax identification number, and the exact name of the fund your gift is directed to in your gift provision.

Legal name: Community Foundation of Tampa Bay, Inc.

Current address: 4300 W. Cypress Street, Suite 700, Tampa FL 33607

Tax identification number: 59-3001853

We are happy to provide you with sample gift by will or trust language to assist you and your attorney.

We also suggest you contact us about creating a Legacy Fund to make clear your intentions regarding our use of the gift in your will or trust at your death. You have complete flexibility to change the gift in your will or trust and your Legacy Fund at any time. If circumstances change in a way that makes you want to revise your gift to us, you can.

Tax Benefits

Because the gift in your will or trust is revocable, you do not receive an income tax charitable deduction when you create it. Rather, your estate will receive an estate tax deduction for the full value of the gift in your will or trust in the year it is made. Depending on a variety of factors, including the size of your estate and estate tax law at the time your estate is settled, this deduction may or may not save estate taxes.

Alternatives to Gift in Will or Trust

In addition to adding gift language to your will or trust, here are a few other simple ways for you to make a legacy gift through the Community Foundation:

- Make a fund at Community Foundation Tampa Bay a designated beneficiary of a life insurance policy.

- Make a fund at Community Foundation Tampa Bay a designated beneficiary of an IRA or other retirement plan.

- Make a fund at Community Foundation Tampa Bay a designated beneficiary of savings bonds.

- Instruct your bank to "pay on death" to a fund at Community Foundation Tampa Bay some or all of a specific bank account.

- Instruct your brokerage firm to "transfer on death" to a fund at Community Foundation Tampa Bay a portion or the entirety of a specific brokerage or other financial account.

Please let us know if you have included Community Foundation Tampa Bay in your estate plans. We would welcome the opportunity to thank you for your thoughtful gift and review the specifications of your gift.

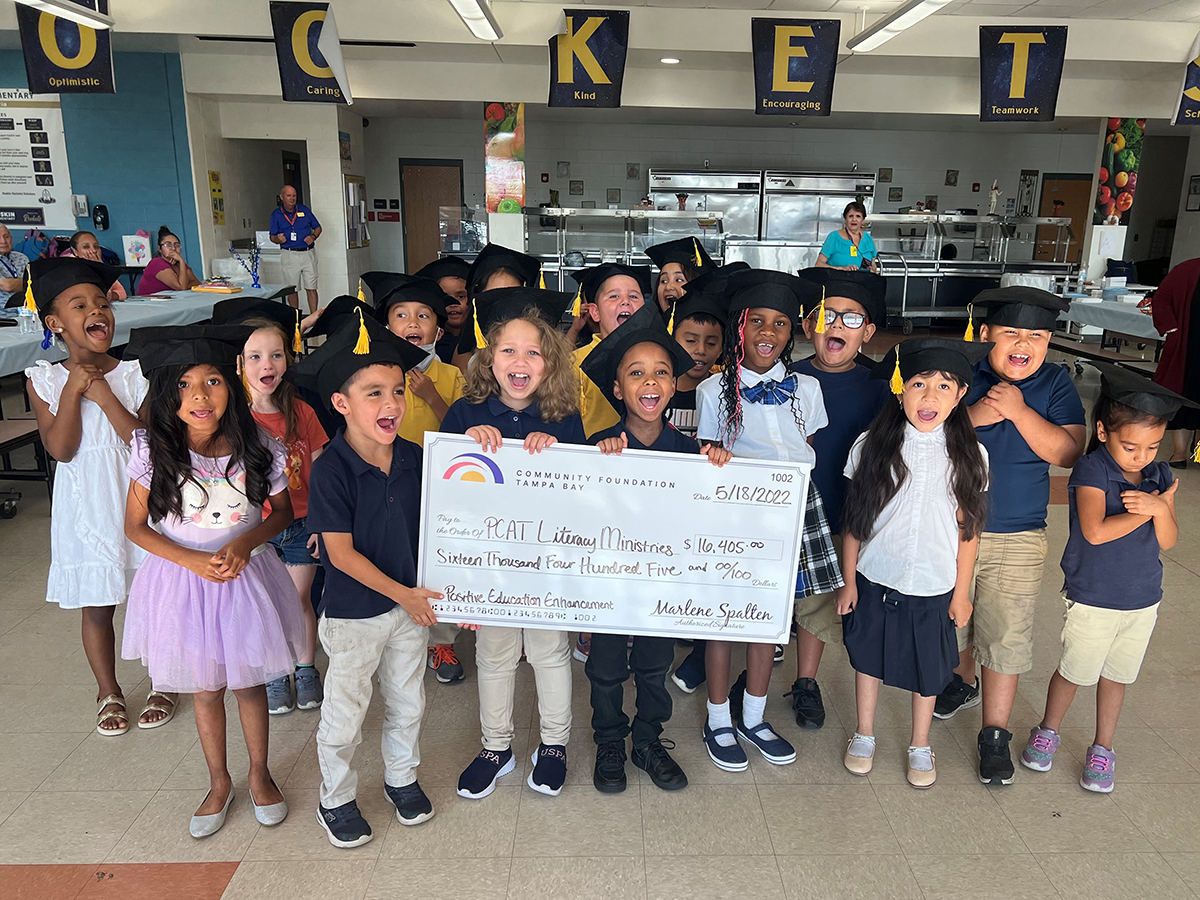

Marie Downs, a widow, has been a supporter of an early childhood literacy program at a local nonprofit and a statewide environmental nonprofit for many years. Marie is in good health now, but does not want to be a financial burden to her children should she require expensive health care in the future.

Marie would like to make a lasting gift to each organization in memory of her husband. After discussing her options with her estate planning advisor, she decides to create a residuary bequest in her will to Community Foundation of Tampa Bay, Inc. to create an endowment fund for her two favorite charities. The endowment will receive the remainder of her estate after all other obligations, such as bequests to her children and grandchildren and taxes, have been taken care of.

Benefits

- Marie’s assets will remain available to her should she need them.

- The revocable nature of her gift will minimize the possibility that she will ever need financial help from her children.

- If her estate is worth what she expects when it is settled, she will be able to provide a generous legacy gift that will provide on-going support after her death to the two charities that have meant the most to her and her late husband.